Kraken’s expansion into traditional financial markets marks a strategic shift for the crypto exchange. By offering commission-free trading of U.S.-listed stocks and ETFs, Kraken is positioning itself as a comprehensive trading platform that bridges the gap between digital assets and traditional financial instruments.

The acquisition of NinjaTrader, a retail futures trading platform, for $1.5 billion further solidifies Kraken’s commitment to diversifying its offerings. This move allows Kraken to tap into the futures trading market, attracting a broader range of investors and traders.

These developments come on the heels of the U.S. Securities and Exchange Commission’s dismissal of a civil lawsuit against Kraken, which the company hailed as a breakthrough against regulatory obstacles. The favorable regulatory environment, coupled with President Donald Trump’s pledges for more crypto-friendly regulations, provides a conducive backdrop for Kraken’s expansion.

Kraken’s co-CEO, Arjun Sethi, emphasized the company’s vision of creating a borderless, crypto-based trading ecosystem. The integration of traditional financial services with crypto offerings aligns with the broader industry trend of convergence between traditional finance (TradFi) and decentralized finance (DeFi).

Key Takeaways

-

Strategic Expansion: Kraken is venturing into traditional finance by offering commission-free trading of U.S.-listed stocks and ETFs.

-

Major Acquisition: The $1.5 billion acquisition of NinjaTrader positions Kraken in the retail futures trading market.

-

Regulatory Milestone: The dismissal of the SEC lawsuit removes a significant regulatory hurdle, paving the way for further expansion.

-

Market Convergence: Kraken’s moves reflect the growing integration of traditional financial services with crypto platforms.

-

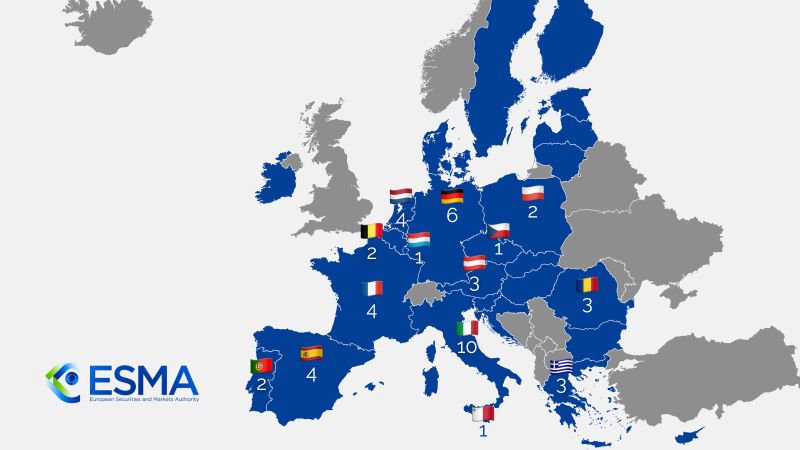

Global Ambitions: Kraken plans to extend its new offerings to international markets, including the UK, Europe, and Australia.

The Broker Radar