IMF Raises Red Flag on FX Liquidity Risks

IMF Warns of Liquidity Strains in $9.6 Trillion FX Market

In its latest Global Financial Stability Report, the International Monetary Fund flagged rising liquidity vulnerabilities in the global foreign exchange (FX) market, now valued at $9.6 trillion. The report stresses that FX markets are often overlooked as conduits for financial stress, especially when derivatives and non‑bank entities are aggressively involved.

The IMF is urging banks, supervisors, and brokers to “enhance FX liquidity stress tests” and maintain robust buffers to absorb sudden funding shocks. It warns that structural fault lines, such as concentrated dollar exposures, off‑balance‑sheet derivatives, and thin liquidity under strain, could propagate stress across markets and institutions.

One particular concern: non‑bank actors (hedge funds, algo trading firms etc.) are increasingly dominant in FX markets, which can magnify volatility when those actors pull back during stress periods. The report also calls for broader use of central bank swap lines and liquidity backstops to shore up cross‑border FX funding stress.

This warning doesn’t come in a vacuum. Brokerages with large FX desks or offering leveraged FX/CFD products may now find themselves in tighter regulatory crosshairs. If a liquidity crunch accelerates, brokers could face funding squeezes, margin pressures, and regulatory demands for more capital or oversight.

What It Means

-

FX/CFD businesses should revisit their stress testing frameworks. What passed as “conservative” before might be hair‑thin under market disruption.

-

Liquidity providers and prime brokers may tighten terms, demand higher margin, or reassess exposure to smaller brokers. That could raise funding costs or reduce credit lines.

-

Regulators may start probing broker balance sheets, derivative exposures, and FX risk management practices more closely. Early movers that preemptively bolster their resilience may gain trust and reputational advantage.

-

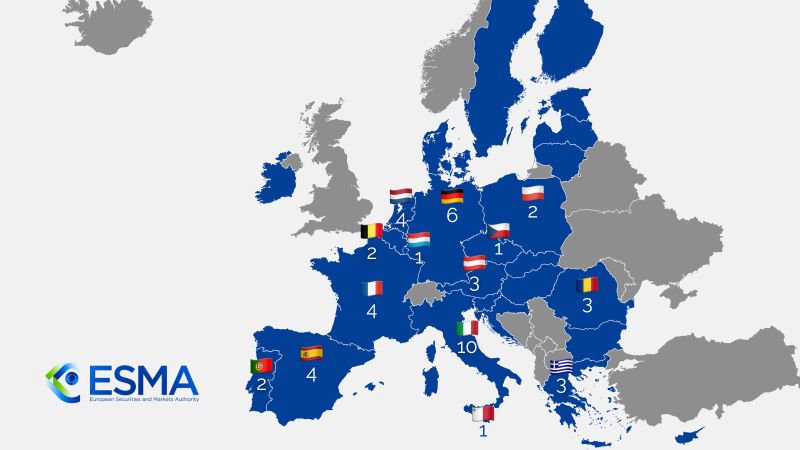

Brokers operating across jurisdictions should monitor how national regulators respond. Some jurisdictions may adopt stricter FX risk rules or reporting requirements sooner.

The Broker Radar