Germany Backs Unified EU Exchange: What Brokers Need to Know

Germany has publicly thrown its support behind the creation of a single European stock exchange, a move that would consolidate fragmented national exchanges into a unified capital markets engine. The proposal, backed by Chancellor Friedrich Merz and echoed by French officials, aims to create a serious rival to U.S. markets in both scale and accessibility.

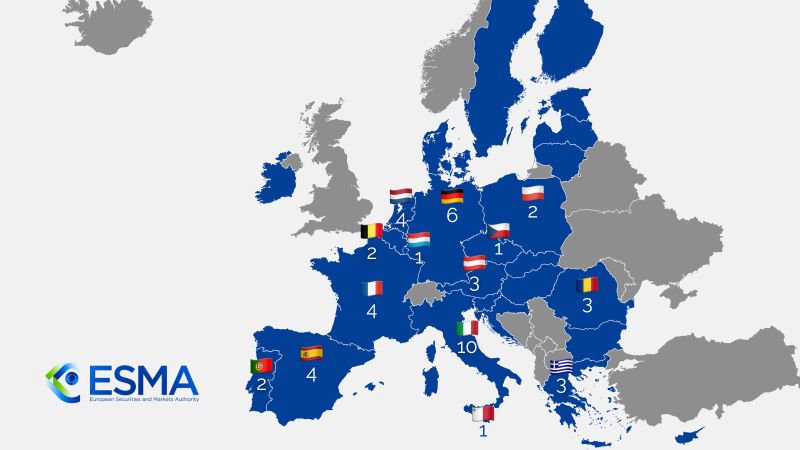

This push is part of broader momentum around the Capital Markets Union (CMU), an EU project to unify financial markets across member states. Merz cited inefficiencies and limited liquidity across national exchanges, calling for a “true European platform” that could attract more listings, boost IPO flows, and strengthen Europe’s competitive position globally.

France’s Finance Minister also recently noted that “Europe cannot rely on 27 small exchanges” and must consolidate to compete. Behind the scenes, pressure is mounting from institutional investors, fintech firms, and EU policymakers for a streamlined market infrastructure.

For brokers and trading platforms, this is not just a policy curiosity, it has teeth.

Implications for Brokers

-

Execution Venue Restructuring

Brokers currently route trades across various national exchanges (Euronext, Deutsche Börse, Borsa Italiana, etc.), often selecting venues based on speed, spreads, or local regulation. A unified exchange could dramatically reshape smart order routing strategies, liquidity access, and internal latency arbitrage models. -

Regulatory Convergence

Currently, brokers operating across EU markets must adapt to a patchwork of local interpretations of MiFID II, tax regimes, and post-trade settlement rules. If a central EU exchange emerges, regulatory expectations could centralize, shifting reporting, audit, and compliance responsibilities. -

Fewer Opportunities for Regulatory Arbitrage

Some brokers leverage jurisdictional advantages, like Cyprus’s lighter regulatory touch or Ireland’s tax flexibility, to offer cheaper services or bespoke access. A single exchange model could neutralise those edge cases, reducing broker flexibility and raising the bar on operational transparency. -

Smaller Exchanges Under Threat

National exchanges may lose relevance, potentially pushing local brokers into tougher conversations about whether to consolidate, specialize, or shift their client base. Local market makers could lose incentives or migrate to centralized venues, changing liquidity profiles. -

Opportunity for Multi-Asset Platforms

For brokers with robust infrastructure, this shift presents an opportunity to scale access and unify infrastructure for EU-based clients. Margining, clearing, and product access could improve — but only for those positioned to integrate quickly.

What It Means

-

Brokers must begin scenario planning now, if order flow starts centralizing, will your platform adapt or fall behind?

-

Technology partners and liquidity providers should be reviewing their venue integration stack; smaller brokers may need to lean on third parties for access if smaller exchanges vanish.

-

Expect consolidation among regional brokers, particularly those relying on niche exchange relationships or regional regulation. The survivors will be those who can offer frictionless access, not just local familiarity.

-

For Broker Radar readers: watch for signs of movement and partnerships between exchanges, cross-listings, or regulatory proposals under CMU. These are early indicators of an accelerating shift.

The Broker Radar