ESMA Seeks Broader Powers Over Crypto & Exchanges Across EU

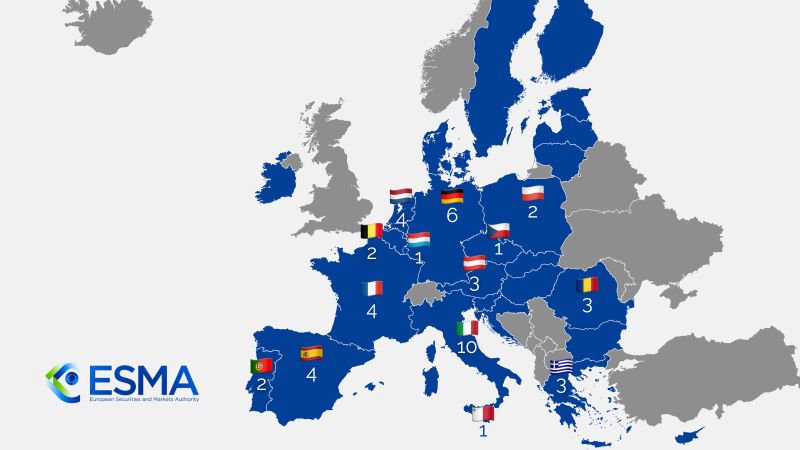

The European Securities and Markets Authority (ESMA) is advancing plans to centralize oversight of crypto asset service providers (CASPs), exchanges, and clearing houses — reducing the role of national regulators and creating unified supervision across the European Union.

Under proposed reforms, ESMA would assume responsibility for supervising providers of consolidated data, ESG rating agencies, and critical cross‑border financial entities. The shift is intended to counter fragmentation in capital markets and ensure consistent enforcement of rules post‑MiCA. The European Commission is reportedly drafting legislation to formalize the transfer of powers.

Smaller EU states (e.g. Luxembourg, Malta) are pushing back, warning that such centralization may weaken local competitiveness in fintech and crypto. The debate is intensifying as ESMA Chair Verena Ross has publicly argued that the current patchwork of supervision is hindering Europe’s ability to compete globally.

For brokers and fintechs operating across multiple EU jurisdictions, a shift to ESMA oversight could mean more uniform regulatory expectations — but also more stringent centralized compliance checks and reduced flexibility at the national level.

What It Means

-

Brokers and crypto platforms with EU footprints must prepare for regulatory harmonization. Compliance teams will need to align with ESMA’s standards, not just local rules.

-

This reform signals a maturation in Europe’s crypto regulation, with the bloc positioning itself as a unified jurisdiction rather than a loose federation of finance regimes.

-

National regulators will lose some control; those in smaller states may resist or lobby for carveouts.

-

For The Broker Radar’s audience: tracking how ESMA defines oversight categories (exchanges, clearing, CASPs) will be critical — the boundaries will determine who falls under centralized vs local authority.

-

Expect a transition period filled with uncertainty, as firms recalibrate reporting lines, licensing approaches, and compliance frameworks. Those that adapt early may gain advantage in cross‑border consistency and regulatory certainty.

The Broker Radar