UK Revokes Retail Ban on Crypto ETNs, Platforms Prepare Launch

The UK’s Financial Conduct Authority (FCA) has officially lifted its five-year prohibition on offering cryptocurrency Exchange-Traded Notes (ETNs) to retail investors, effective 8 October 2025. Retail platforms including FreeTrade and Interactive Investor plan to roll out crypto ETN products, while major brokers such as IG, eToro, Hargreaves Lansdown, and AJ Bell are evaluating timelines or readiness for market entry.

Under the reopening, these ETNs must comply with the FCA’s Consumer Duty rules, meaning brokers will need to ensure these products are suitable, transparent, and clearly communicated to clients. One notable caveat: crypto ETNs will not be covered by the FSCS (Financial Services Compensation Scheme), reinforcing that clients carry full risk.

The product structure is likely to be analogous to European crypto ETPs (Exchange-Traded Products), but with the wrapper of an ETN — meaning credit risk on the issuer is a factor alongside cryptocurrency exposure. The consumer access point could include listing these instruments on retail brokers’ platforms and possibly making them eligible for Inclusion in ISA-like products, although HMRC hasn’t confirmed tax treatment yet.

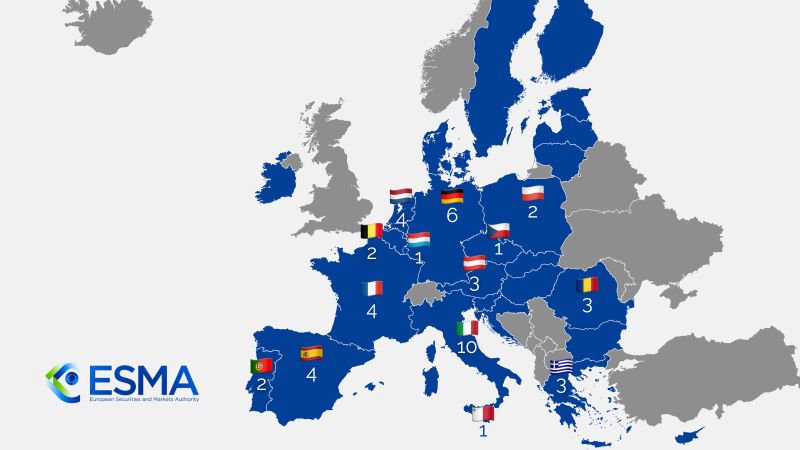

This regulatory pivot aligns with broader shifts in global brokerage markets, where structured crypto products are increasingly seen as bridges between traditional finance and digital assets. The UK’s reopening could challenge continental Europe’s market leadership in crypto ETPs, especially in jurisdictions where retail participation is tightly regulated.

What It Means

-

Brokers with existing equity/ETF infrastructure (e.g. IG, eToro, HL) are in prime position to layer crypto ETNs, but success hinges on compliance, product design, and investor education.

-

Issuers of ETNs will face pressure to manage credit risk, liquidity, and collateral structures transparently; missteps could tarnish trust in crypto‑wrapped instruments.

-

Retail adoption may take time — the “no FSCS protection” point is a barrier. Many clients will treat these as high-risk, speculative vehicles rather than long-term holdings.

-

The UK’s move may spur competitive responses in EU/UK-adjacent jurisdictions (e.g. Switzerland, Liechtenstein) to reshape where retail crypto structuring is offered.

-

For The Broker Radar, this is a signaling event: structured products (ETNs, ETPs) will likely become a battleground for broker differentiation over the next 12–18 months.

The Broker Radar