Our fundamental analysis highlight new and old tools and frameworks to help traders stay ahead:

Key Metrics: Gross Domestic Product (GDP), Consumer Price Index (CPI), Producer Price Index (PPI), and non-farm payrolls (NFP) drive currency valuations. Composite indices like the ISM Manufacturing PMI provide broader economic insights, with U.S. PMI at 50.2 in May 2025, signaling growth.

Climate Impact: Green energy policies bolster currencies like EUR and CNY, while fossil fuel exporters (e.g., CAD, RUB) face volatility due to shifting global demands.

Supply Chain: Ongoing post-COVID disruptions, with 15% higher shipping costs in 2025, impact commodity-reliant currencies like AUD and NZD.

Economic calendars are essential for tracking high-impact events like NFP, GDP, and CPI releases. In 2025, advanced calendars include CFTC Commitment of Traders data for positioning insights.

Example: The U.S. NFP release on June 6, 2025, exceeded forecasts at 250,000 jobs, strengthening USD by 0.8% against EUR.

Central Bank Digital Currencies (CBDCs): Over 100 countries, including China, are piloting CBDCs, potentially reshaping currency flows.

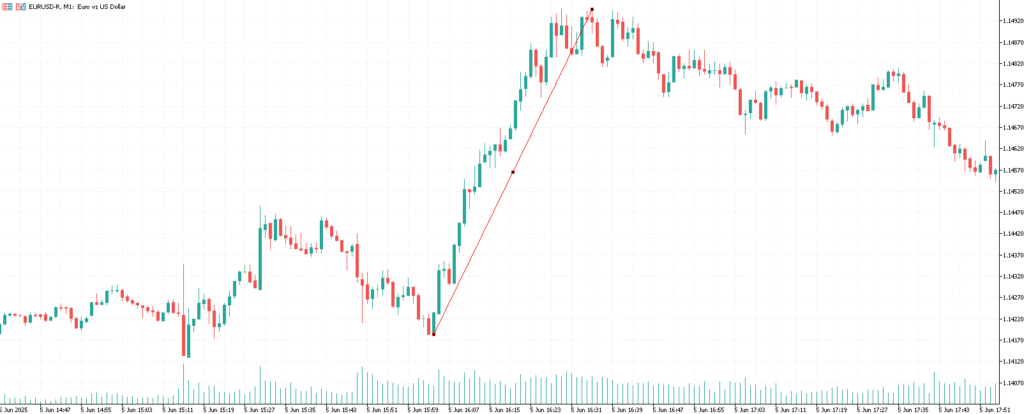

Forward Guidance: The ECB’s April 2025 rate cut to 2.25% signaled dovish policy, weakening EUR, while the Bank of Canada held rates at 2.75% amid U.S. trade policy uncertainty.

Tools: Central bank trackers, integrated into platforms like The Broker Radar, provide real-time policy updates.

GDP: Advance estimates, such as U.S. Q1 2025 GDP growth at 2.8%, signal economic strength, boosting USD.

Inflation: Core CPI, excluding volatile food and energy, is prioritized, with U.S. core CPI at 3.2% in May 2025, influencing Fed rate expectations.

Action: Use The Broker Radar’s market news for real-time GDP and CPI updates.

Geopolitical Risks: Middle East tensions, like Israel-Iran conflicts in June 2025, spiked oil prices 9%, strengthening CAD.

Supply Chain: Higher shipping costs in 2025 inflate AUD and NZD due to commodity reliance.

Tools: Geopolitical risk indices, accessible via The Broker Radar’s news section, offer early warnings.

Tech Economies: Japan’s AI and robotics advancements strengthened JPY by 1.2% in Q2 2025.

AI Tools: Platforms like The Broker Radar integrate AI-driven indicators to analyze GDP and inflation trends, used by 60% of professional traders.

To apply fundamental analysis effectively in 2025, we have seen success from the follow steps:

Use Trading Economics calendar to track NFP, GDP, and CPI releases – Trading Economics Calendar.

Action: Set alerts for “high” impact events and review positioning data to anticipate market moves.

Track ECB, Fed, and BoJ statements via The Broker Radar’s news updates.

Action: Trade EUR/USD post-ECB decisions, expecting 0.5–1% moves based on 2025 trends.

EUR/USD Movement After ECB Rate Cut 2025

Compare GDP and CPI against forecasts.

Action: If U.S. CPI exceeds 3.5%, buy USD/JPY, targeting 50 pips, as seen in May 2025.

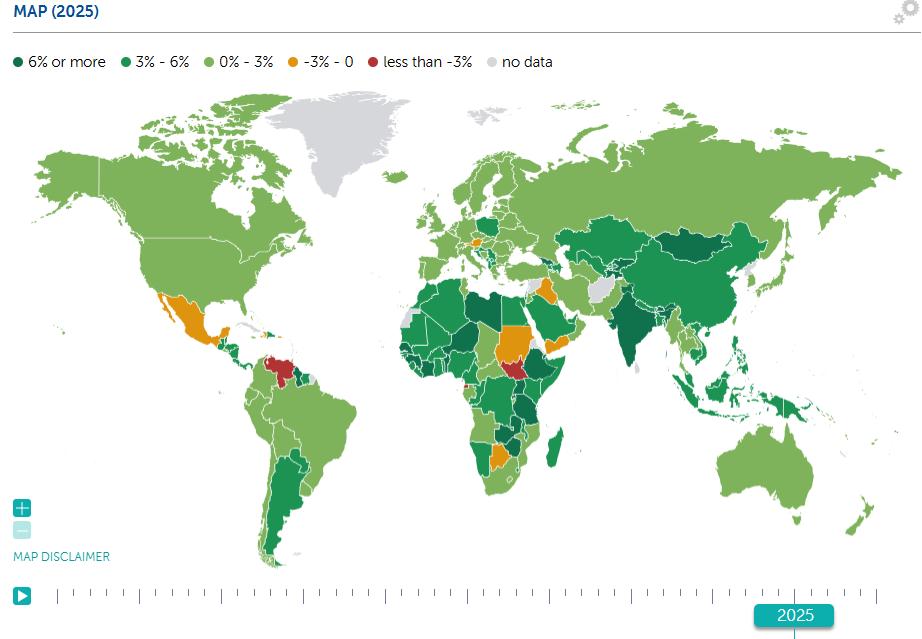

Image from imf.org

Image from imf.org

Monitor geopolitical risk updates using Reuters.

Action: Buy CAD/USD during oil price spikes, as in June 2025.

Use AI-driven indicators on platforms like Tradingview to analyze economic data.

Action: Set alerts for GDP revisions, trading AUD/USD on 0.3% shifts.

Use MT4/5 support/resistance levels post-fundamental events, accessible via our platform tutorials.

Action: Enter GBP/USD trades after BoE rate decisions, confirming with the 200-day moving average. Learn technical analysis.

Choosing the right broker is key for fundamental traders. Here are our top picks:

CMC Markets: Offers real-time Reuters news feeds, 0.6-pip spreads on EUR/USD, and stable execution during NFP releases.

See our CMC Markets Review, or visit CMC Markets now.

Interactive Brokers: Provides comprehensive economic calendars and in-platform news, with 99.9% uptime during high-impact events. See our Interactive Brokers Review, or visit Interactive Brokers now.

Saxo Bank: Delivers proprietary research and macroeconomic reports, ideal for GDP-driven trades

visit Saxo Bank now

Why These Brokers?

News Access: CMC Markets and Interactive Brokers integrate Reuters and Bloomberg feeds for instant updates.

Execution: All three maintain tight spreads (e.g., 0.6 pips) and low slippage during volatility.

Research: Saxo’s 50+ weekly reports rival institutional tools, enhancing fundamental strategies.

Our recommendation for trading fundamentals is CMC Markets – sign up here 🚀

Mastering fundamental analysis in Forex trading for 2025 requires staying informed about economic indicators, central bank policies, and geopolitical events. By combining these insights with technical analysis and choosing a broker like CMC Markets, traders can navigate markets effectively.

Stay ahead with The Broker Radar’s education, new and broker reviews.

Start trading today!