MetaTrader 4 (MT4), developed by MetaQuotes Software in 2005, is a leading electronic trading platform renowned for its user-friendly interface, advanced charting tools, and automated trading capabilities. It supports trading in forex, commodities, indices, stocks, and cryptocurrencies via Contracts for Difference (CFDs), making it a versatile choice for traders globally.

Popularity: Millions of traders use MT4, creating a vast community with extensive resources.

Reliability: Stable performance with minimal downtime ensures consistent trading.

Customization: Tailor the platform to your needs with custom indicators and templates.

Automation: Expert Advisors (EAs) enable automated trading strategies.

MT4’s flexibility makes it ideal for both beginners and professionals, offering tools to analyze markets, execute trades, and manage risk effectively.

To use MT4, select a trusted broker that supports the platform. Top recommendations include:

CMC Markets: Offers tight spreads and advanced MT4 tools (CMC Markets).

Interactive Brokers: Provides a wide range of markets and educational resources (IBKR).

Vantage: Known for its beginner-friendly interface and fast execution (Vantage).

Broker Radar Tip: Check broker reviews on The Broker Radar to find one with low fees and reliable MT4 support.

Start your MT4 journey with CMC Markets today!

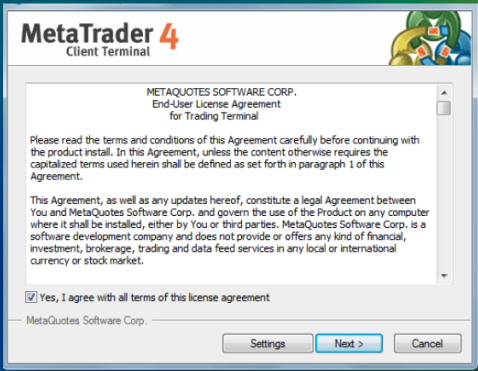

Visit your broker’s website and locate the MT4 download link (e.g., under “Platforms” or “Trading Tools”).

Download the MT4 installer for your device (Windows, Mac, iOS, or Android).

Run the installer and follow the prompts to complete setup.

Open MT4 and log in using your broker-provided trading account credentials (username, password, server).

MT4’s interface is intuitive but packed with features. Key components include:

Market Watch: Lists available trading instruments (e.g., EUR/USD, GBP/JPY).

Navigator: Accesses indicators, EAs, scripts, and account details.

Terminal: Displays trade history, account balance, and news feeds.

Charts: The main area for market analysis with customizable charts.

Step-by-Step Guide:

Open Market Watch (View > Market Watch or Ctrl+M) to view currency pairs.

Right-click a pair (e.g., EUR/USD) and select “Chart Window” to open a chart.

Explore the Terminal (Ctrl+T) to check your account balance and open trades.

Broker Radar Tip: Drag windows to rearrange the layout for a personalized workspace.

MT4 offers nine timeframes (M1 to MN) and three chart types (line, bar, candlestick). Essential tools include:

Trend Lines: Draw support and resistance levels to identify price trends.

Fibonacci Retracement: Pinpoint potential reversal zones.

Moving Averages: Smooth price data to spot trends.

Step-by-Step Guide:

Open a chart (right-click a pair in Market Watch > Chart Window).

Select “Candlestick” from the toolbar for detailed price action.

Click “Insert” > “Lines” > “Trendline” to draw support/resistance.

Use “Insert” > “Fibonacci” > “Retracement” to apply levels.

Broker Radar Tip: Use candlestick charts for better price action analysis, especially on H1 or H4 timeframes.

MT4 includes over 30 built-in indicators to analyze market trends:

Moving Average Convergence Divergence (MACD): Measures trend strength and momentum.

Relative Strength Index (RSI): Identifies overbought/oversold conditions.

Bollinger Bands: Highlights volatility and potential breakouts.

Step-by-Step Guide:

Open a chart and click “Insert” > “Indicators” > “Trend” > “Moving Average.”

Adjust settings (e.g., period: 50) and apply.

Add RSI by selecting “Insert” > “Indicators” > “Oscillators” > “Relative Strength Index.”

Customize RSI settings (e.g., period: 14) and click “OK.”

Broker Radar Tip: Combine MACD and RSI for confirmation signals (e.g., MACD crossover with RSI above 50).

MT4 supports multiple order types to execute trades:

Market Orders: Buy/sell at the current market price.

Pending Orders: Set buy/sell orders at specific prices (e.g., Buy Limit, Sell Stop).

Stop-Loss/Take-Profit: Automatically close trades at predefined loss/profit levels.

Step-by-Step Guide:

Press F9 or click “New Order” in the toolbar.

Select “Market Execution” for immediate trades or “Pending Order” for future trades.

Set Stop-Loss (e.g., 20 pips below entry) and Take-Profit (e.g., 40 pips above entry).

Click “Buy” or “Sell” to place the order.

Broker Radar Tip: Always set stop-loss orders to limit losses, especially during volatile news events.

EAs are automated trading systems that execute trades based on algorithms, ideal for traders seeking efficiency.

Step-by-Step Guide:

Open Navigator (Ctrl+N) and locate “Expert Advisors.”

Drag an EA (e.g., Moving Average Crossover) onto a chart.

Adjust settings (e.g., lot size: 0.1, MA period: 20) in the pop-up window.

Enable “AutoTrading” in the toolbar (green play button).

Broker Radar Tip: Start with simple EAs on a demo account to test performance before live trading.

Integrate technical setups with fundamental news for better trade timing.

Example: Trade EUR/USD after ECB rate decisions (fundamental trigger) using a breakout strategy (technical setup).

How: Monitor news via MT4’s Terminal > News tab or The Broker Radar’s market updates.

Broker Radar Tip: Avoid trading during high-impact news unless you’re scalping with tight stop-losses.

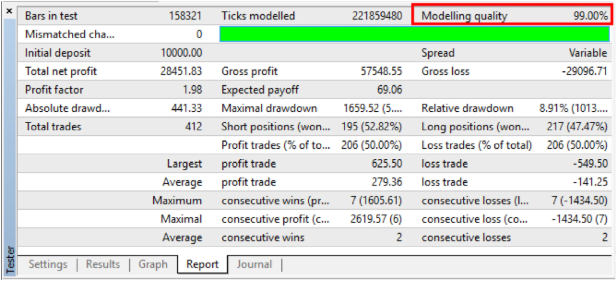

MT4’s Strategy Tester allows you to test EAs or manual strategies on historical data.

Step-by-Step Guide:

Open Strategy Tester (View > Strategy Tester or Ctrl+R).

Select an EA or manual strategy from the dropdown.

Choose a currency pair (e.g., EUR/USD) and timeframe (e.g., H1).

Set the date range (e.g., January 2025–June 2025) and click “Start.”

Review results (e.g., profit, drawdown) in the “Report” tab.

Broker Radar Tip: Optimize EA settings based on backtest results to improve live performance.

Protect your capital with disciplined risk management:

Position Sizing: Risk no more than 1–2% of your account per trade.

Diversification: Trade multiple currency pairs to spread risk.

Hedging: Open opposite positions to mitigate losses during volatile markets.

Step-by-Step Guide:

Calculate position size using MT4’s “Trade” tab (e.g., 0.1 lot for a $10,000 account with 1% risk).

Set stop-loss orders 20–30 pips from entry for short-term trades.

Monitor open trades in the Terminal > Trade tab.

Broker Radar Tip: Use MT4’s Account History tab to analyze past trades and refine your risk strategy.

Personalize MT4 to suit your trading style:

Rearrange windows (e.g., drag Market Watch next to charts).

Save custom templates (File > Template > Save Template).

Create profiles for different strategies (View > Profiles > Save Profile).

Broker Radar Tip: Save a template with your favorite indicators (e.g., MACD, RSI) for quick setup.

Speed up trading with MT4’s hotkeys:

F9: Open New Order window.

Ctrl+M: Toggle Market Watch.

Ctrl+T: Show/hide Terminal.

Step-by-Step Guide:

Go to File > Options > Keyboard to view or customize hotkeys.

Practice using F9 to place orders quickly during fast-moving markets.

Broker Radar Tip: Memorize 3–5 key hotkeys to streamline your workflow.

Enhance MT4 with custom tools:

Download free indicators or EAs from MQL5 Community.

Install by copying files to MT4’s “Indicators” or “Experts” folder (File > Open Data Folder).

Broker Radar Tip: Verify third-party tools on a demo account to ensure compatibility.

Mistake: Opening too many positions, leading to losses.

Solution: Limit trades to 2–3 per session and track frequency in MT4’s Account History.

Mistake: Trading without stop-loss orders.

Solution: Set stop-losses for every trade in the New Order window.

Mistake: Using untested EAs or strategies in live trading.

Solution: Backtest strategies in Strategy Tester before going live.

Broker Radar Tip: Review MT4’s Journal tab for error logs to troubleshoot issues like failed trades or EA glitches.

Mastering MetaTrader 4 (MT4) is a game-changer for forex traders, offering powerful tools to analyze markets, execute trades, and automate strategies. By following this guide, you’ll navigate MT4’s interface with ease, leverage its charting and trading features, and implement effective risk management. Whether you’re scalping EUR/USD or building a long-term portfolio, MT4’s flexibility empowers your success.

Ready to trade with confidence? Sign up with CMC Markets today and start your MT4 journey! 🚀 Explore more trading guides on The Broker Radar or find your perfect broker at Broker Reviews.